Latest News

Evolution, Challenges, and Reforms in India's Investor-State Dispute Settlement Mechanisms

Evolution, Challenges, and Reforms in India's Investor-State Dispute Settlement Mechanisms

INTRODUCTION:

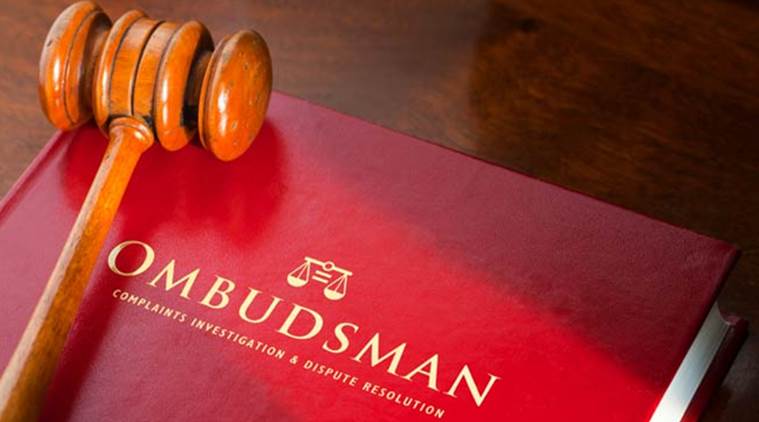

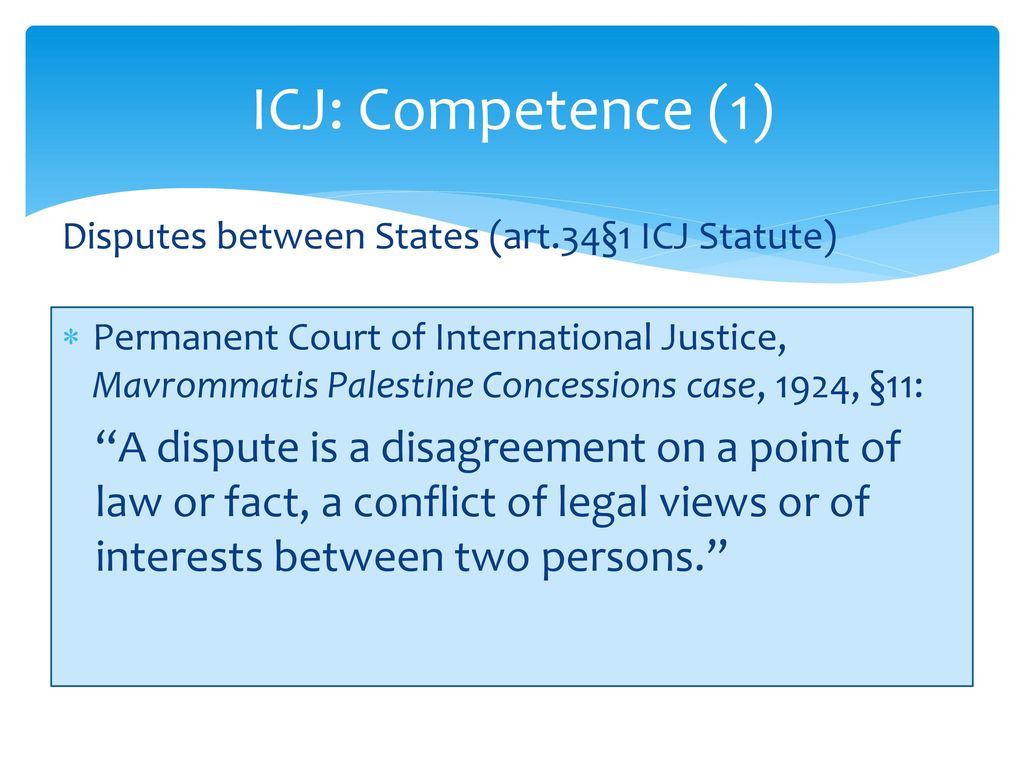

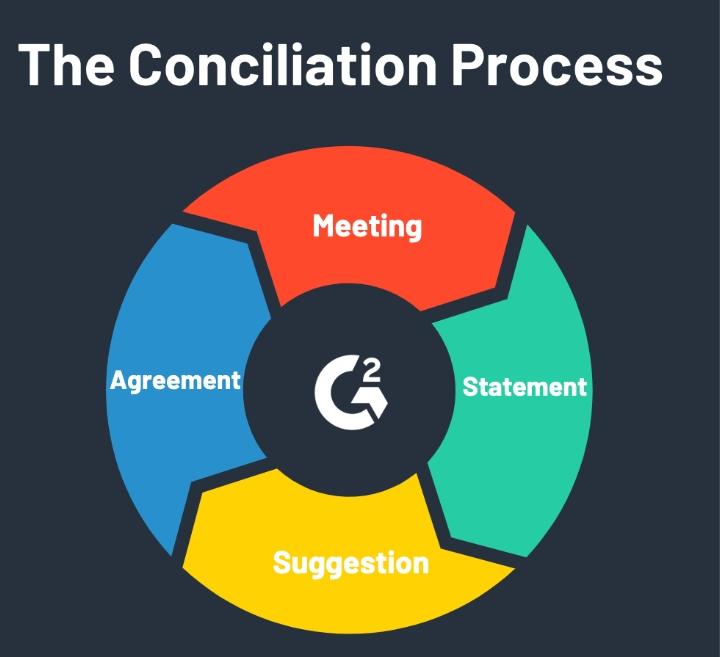

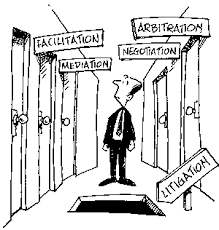

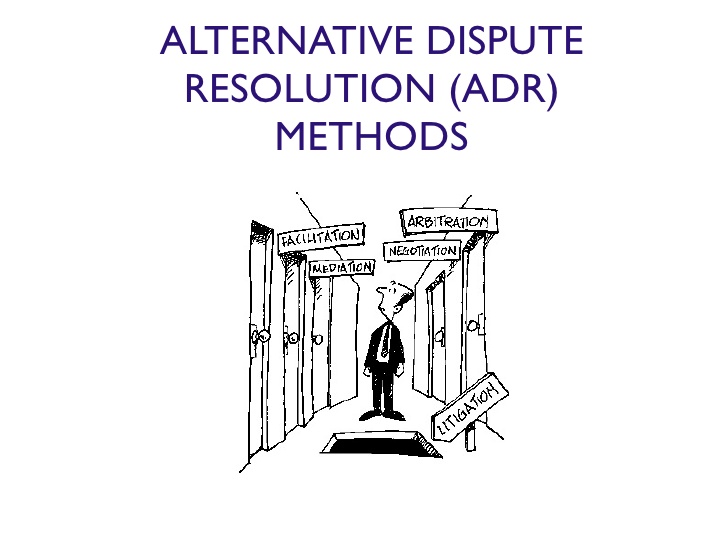

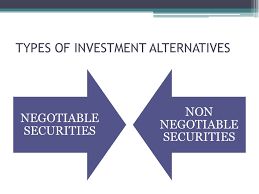

Investor-State Dispute Settlement (ISDS) mechanisms play a crucial role in international investment law, offering a neutral platform for resolving conflicts between foreign investors and host states. Designed to depoliticize disputes arising from alleged breaches of treaty obligations by host states, ISDS aims to safeguard foreign investments, fostering a predictable legal framework to encourage cross-border investments and economic growth. In India, a burgeoning economy, the influx of foreign investments has led to the establishment of numerous Bilateral Investment Treaties (BITs) containing ISDS provisions to protect and promote such investments. Despite this, India has faced high-profile disputes resulting in significant financial liabilities, prompting a reevaluation of its ISDS approach and the adoption of a new Model BIT in 2015. This research delves into the historical evolution, current status, and prospects of India's ISDS mechanisms within its BITs. Tracing policy shifts over time, with a focus on the 2015 Model BIT, the analysis sheds light on the factors shaping India's ISDS policy and the challenges in balancing investor protection with sovereign regulatory rights. Examining key features, such as arbitral institutions, ISDS scope, local remedy exhaustion, Most-Favored-Nation clauses, and transparency levels, the paper provides an in-depth analysis of the dispute resolution process. Furthermore, the paper scrutinizes challenges associated with India's ISDS mechanisms, including perceived bias, arbitral award inconsistency, absence of appellate mechanisms, and the cost and duration of proceedings. Addressing these issues, the paper proposes reforms like strengthening domestic legal frameworks, promoting alternative dispute resolution methods, establishing an appellate mechanism, and enhancing transparency and stakeholder participation. Ultimately, the research aims to contribute to the discourse on the fairness and effectiveness of ISDS in protecting foreign investments and fostering a stable investment climate in India, while ensuring a balance between the interests of foreign investors and the host state.

EVOLUTION OF ISDS MECHANISMS IN INDIA:

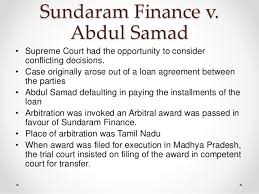

The evolution of Investor-State Dispute Settlement (ISDS) mechanisms in India's Bilateral Investment Treaties (BITs) can be traced through different phases, commencing with the early BITs signed between 1994 and 2011. During this period, India's BITs were characterized by a traditional approach to ISDS, emphasizing broad investor protections and limited host-state exceptions. These agreements permitted foreign investors to bring disputes to international arbitration without exhausting local remedies, and Most Favored Nation (MFN) clauses allowed them to benefit from more favourable dispute resolution provisions in other treaties. However, this approach led to high-profile disputes, such as the White Industries case in 2011[1], prompting a reevaluation of India's ISDS mechanisms. In response, the Indian government introduced the 2015 Model BIT, a departure from the traditional approach. The new model emphasized a balance between investor protection and India's regulatory sovereignty. It mandated the exhaustion of local remedies before initiating ISDS proceedings, discouraging direct resort to international arbitration and allowing the host state to address grievances domestically. Moreover, the 2015 Model BIT[2] restricted the applicability of the MFN clause in ISDS provisions to prevent "treaty shopping." It also introduced precise definitions for key terms like "investment" and "investor" and included exceptions and carve-outs to safeguard the host state's policy space. This shift in approach influenced India's renegotiation of existing BITs, leading to the termination of some agreements and the negotiation of new treaties that incorporated the revised ISDS mechanisms. Recent BITs, such as the India-Belarus and India-Taiwan agreements, demonstrate the influence of the 2015 Model BIT, incorporating provisions like local remedies exhaustion, limited MFN clause applicability, and precise definitions of key terms. In addition to bilateral negotiations, India has actively participated in discussions on ISDS reform at the United Nations Commission on International Trade Law (UNCITRAL). These discussions aim to address challenges associated with ISDS mechanisms, indicating India's commitment to refining and improving ISDS in response to emerging criticisms and challenges. Overall, India's ISDS evolution reflects a transition from a focus on broad investor protections to a more balanced approach considering the host state's policy space and regulatory rights.

CHALLENGES FACED BY INDIA’S ISDS MECHANISMS:

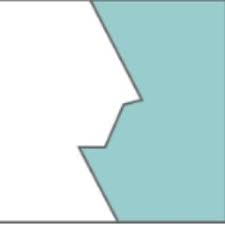

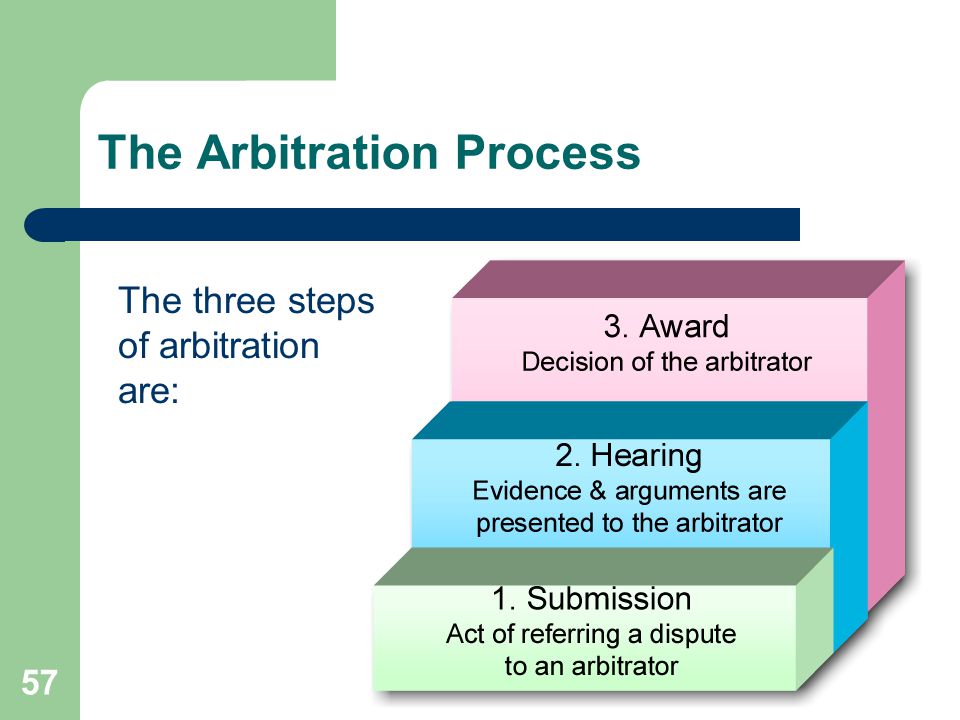

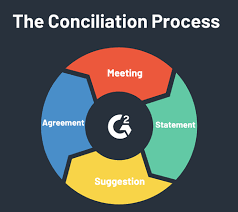

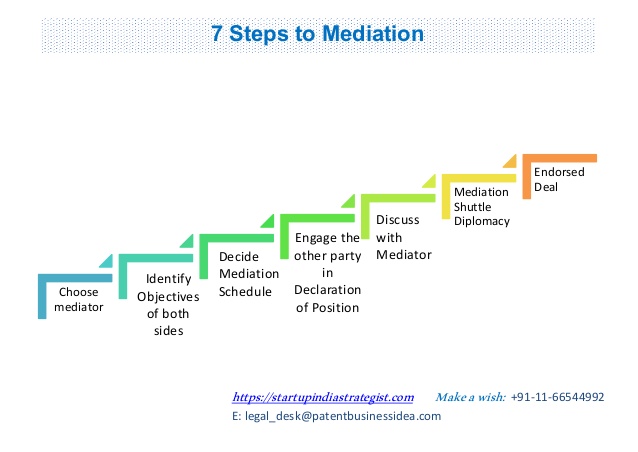

India's Investor-State Dispute Settlement (ISDS) mechanisms have faced substantial challenges and criticisms, primarily centred on perceived biases against developing countries, inconsistency in awards, the absence of appellate mechanisms, and the high cost and prolonged duration of ISDS proceedings. Critics argue that the ISDS system in India tends to favour developed nations and their investors, resulting in unjust outcomes for developing countries like India. This perceived bias is attributed to various factors, including the dominance of arbitrators from developed countries, insufficient resources and expertise for developing nations, and interpretations of Bilateral Investment Treaties (BITs) that allegedly disproportionately benefit investors from developed nations. To address this bias, India's 2015 Model BIT introduced provisions aiming for a more balanced ISDS approach. The model includes precise definitions of key terms and underscores the host state's right to regulate in the public interest, intending to create a more equitable system. Another significant challenge is the inconsistency and unpredictability of arbitral awards. Critics argue that the lack of a centralized body of jurisprudence, reliance on ad hoc tribunals, and diverse interpretations of treaty provisions contribute to this issue. In response, the 2015 Model BIT incorporates detailed provisions on substantive standards and procedural rules to enhance clarity and consistency. The absence of appellate mechanisms is also criticized, as the current system limits review to procedural irregularities or jurisdictional errors, neglecting substantive errors. Proposals, including one from UNCTAD[3] for a multilateral appellate body, aim to rectify this gap, providing a means to correct substantive errors and fostering a more predictable jurisprudence. Additionally, the high cost and lengthy duration of ISDS proceedings pose significant challenges, potentially deterring claimants, especially smaller enterprises. Proposed measures, such as expedited procedures, fixed timelines, and alternative dispute resolution mechanisms, could mitigate these issues. In conclusion, addressing these multifaceted challenges is imperative for bolstering the credibility, legitimacy, and effectiveness of India's ISDS system in safeguarding foreign investments and nurturing a stable investment climate[4]. Future policy efforts should focus on targeted reforms, such as fortifying domestic legal frameworks, endorsing alternative dispute resolution, establishing appellate mechanisms, and enhancing transparency and stakeholder participation in the ISDS process.

[1] Ranjan, P., & Anand, P. (2020). Indian courts and Bilateral Investment Treaty Arbitration. Indian

Law Review, 4(2), 199–220. https://doi.org/10.1080/24730580.2020.1732693.

[2] Ranjan, P. (2017). The 2016 Indian Model Bilateral Investment Treaty: A critical deconstruction.

SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2946041.

[3] United Nations Conference on Trade and Development (UNCTAD), "World Investment

Report 2021: International Production Beyond the Pandemic," 2021.

[4] Ranjan, P. (2021). Investor-state dispute settlement (ISDS) cases and India: Affronting regulatory

autonomy or indicting capricious state behaviour? SSRN Electronic Journal.

https://doi.org/10.2139/ssrn.3911220.

- Despite this, India has faced high-profile disputes resulting in significant financial liabilities, prompting a reevaluation of its ISDS approach and the adoption of a new Model BIT in 2015.

- The new model emphasized a balance between investor protection and India's regulatory sovereignty.

- India's 2015 Model BIT introduced provisions aiming for a more balanced ISDS approach, with precise definitions of key terms and a focus on the host state's right to regulate in the public interest.